Hello all,

Before we move onto all observations of BHEL, herein I share something which I enjoy doing along with my fund management activity.

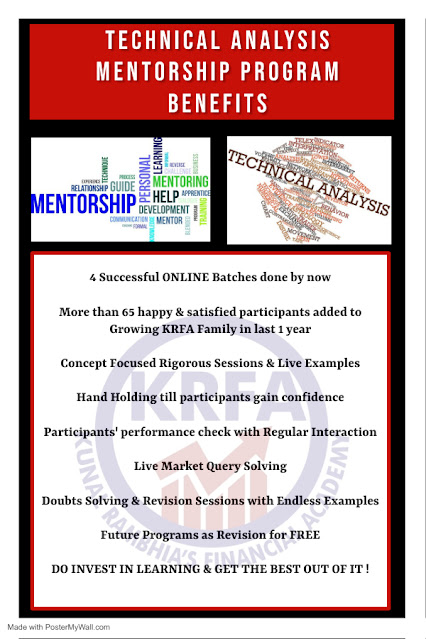

I conduct online sessions to teach Technical Analysis. The online journey started a year back and we, at KRFA, have conducted 4 online sessions by now (and many offline sessions in the last 3 years), adding more than 65 participants to our growing KRFA family. The new batch for the session is upcoming next week. Details are shared here. I would feel fortunate to serve you all; if anyone of you wishes to learn Technical Analysis. Feel free to contact KRFA at 7045968847.

Let's begin with observations of BHEL. First, we look at the monthly chart to understand broader

formation.

Monthly Price Action:

Price is in decline mode for a decade. But it was contracting in nature, creating falling wedge formation, which is bullish in nature.

Breakout of the falling wedge was seen during Feb 2021. Follow-through price action is seen in the present month. The price made bottom during April 2020 and since then volume is supporting the uptick. Volumes recorded are the highest ever recorded since the listing. Similar volumes were seen during 2000, confirming accumulation volume.

Price is showing a decisive curve formation on the chart. The declining trendline breakout confirms the emergence of a new trend.

The higher top higher bottom is confirmed based on the breakout of a black dotted line. The recent uptick is showing a perfect trend after retesting the breakout level.

The blue line (previous high) breakout will confirm a curve formation breakout.

Every uptick is confirmed with positive Volume activity (highlighted with trendline on volume). This confirms the likely emergence of a new trend.

MACD on the weekly chart:

MACD has crossed 'zero' line and has traded decisively above that, confirming the emergence of a bullish trend.

Moving Average on the weekly chart:

160 period's EMA on the weekly chart is decisively offering resistance since 2015. The specific observation is that it's the first time that price is attempting to trigger a breakout immediately after the first attempt. On the breakout of the EMA, the uptrend will get moving average confirmation.

Ichimoku on the weekly chart:

This indicator confirms the trend of the price. June 2015 was a failed attempt to cross the Kumo cloud. May - June of 2017 was again a failed attempt. Presently, the cloud is turned comparatively thin and the price has decisively remained about the same and also made higher top higher bottom too. Future cloud is also showing bullishness and price is trending well above Tenkan & Kijun along with Chikou in free air above the price. All confirm the beginning of a new trend.

ADX DMI on the weekly chart:

This indicator confirms the strength of the trend. Since bottom formation in April 2020, clear HTHB is seen on the price action. +DMI is turned dominating, crossed 25 levels, and "cross & hold" is in action. Eventually, ADX has surpassed 25 levels, confirming the strength of the move.

Fibonacci Extension on the weekly chart:

Fibonacci is used as the price is forming a series of HTHB. This tool helps to define the approximate target on the price action. Using the first swing, the approximate target comes to 68 (161.8% extension) and 93 (261.8% extension).

Putting it all together:

Monthly as well as the weekly timeframe is confirming a firm price action underway for the counter. Looking at various indicators and price action, it seems safe to accumulate the counter on every level. Unless a massive downside emerges on the counter, its uptrend will remain intact.

Follow me on Twitter @RambhiaKunal for regular updates !

Launching youtube channel Named "KunalRambhia". Do subscribe for educational updates !

Statutory Disclosure:

Kindly note that this update is only for educational purpose. It is safe to assume that my personal position, my fund's position, and my client's, as well as relative's position, may be open in the counter. Prefer to take the advice of your financial advisor before initiating any position.

No comments:

Post a Comment